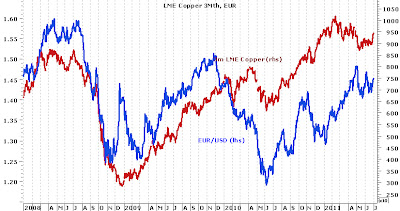

Two factors are probably the catalyst for a strong recovery of base metals last week. And both factors are repeating the history. Like in the summer of 2010, base metals suffered also this year under the debt crisis in Greece and the impact on the euro as well as on talk of a double-dip recession in the US

After the Greek PM Papandreou survived a confidence vote in the parliament already the week before, investors were still cautious. Rumors were spread around that the austerity package would not find a majority in the Greek parliament. However, even before the final vote on the austerity package took place, sentiment improved. Strikes and unrests at the Syntagma Place Greece

The second factor contributing to the strong recovery of base metals was US Japan

While the media criticized the Fed for this more cautious stance, the economic data released during the past week indicates that the Fed is still smarter than many journalists and academic scribblers’ comments in news-papers. At the beginning of the week, the Richmond Fed index rebounded from -6 to +3. The pending home sales also posted a far stronger gain than the consensus had expected. However, more important had been the ISM purchasing index for the manufacturing sector in Chicago

Furthermore, the HSBC PMI for China China

No comments:

Post a Comment