The major factor for commodity markets is currently the unrest in Libya Tripoli

The unrest in Libya North Africa . Brent surged to as much as120$/bbl but came down again as Saudi Arabia announced to increase production by 700,000 barrels per day and thus nearly compensating the production shortfall in Libya. Nevertheless, Brent ended the week at 112.43$/bbl, which is 9.7% higher than one week ago. The spread of Brent over WTI increased again to 14.19$/bbl.

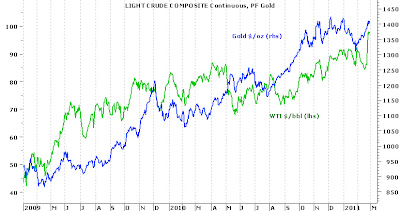

The surge of crude oil prices will have an impact on headline consumer price inflation in industrialized and emerging economies around the globe. Thus, one would expect that gold were rising stronger. The argument that central banks would have to hike interest rates now even more is not a convincing argument against buying gold. The Fed is clearly focusing on the core PCE inflation rate. The rise of crude oil prices is unlikely to derail QE2. The soaring energy prices are likely to have a dampening impact on GDP growth. In the case that central banks try to fight the impact of higher crude oil prices on headline CPI inflation, they are likely to reduce GDP growth even more and could drive their economies into a recession. Therefore, central banks might accept temporarily higher headline inflation as long as core inflation remains well behaved. The hypothesis that the global economy would enter a period of stagflation is already spread around. You guessed right, the “new normal” is dead and the PIMCO snake oil salesmen have a new medicine to promote. But if one is expecting stagflation, then the better alternative is buying gold and silver instead of PIMCO funds.

Platinum and palladium suffered under their industrial use and could not post a gain on the week. Platinum lost 1.7% and palladium plunged by 7.1%. Again, the price moves of car company equities was a good guideline for the PGMs. The market fears that higher costs for fuel would reduce expenditures for cars and that automotive manufacturer would buy less platinum and palladium for catalytic converters.